Tokenomics

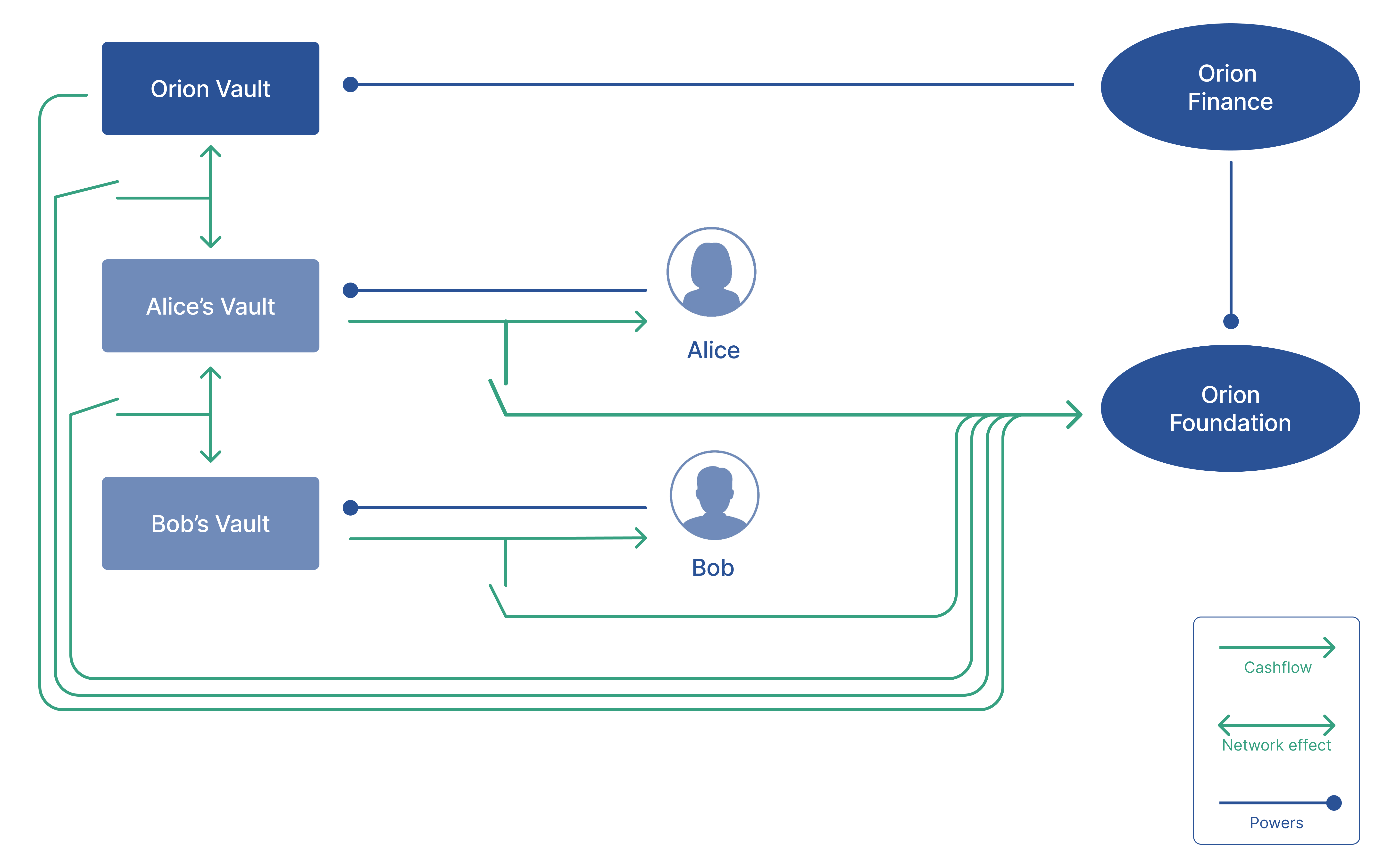

The ORION token is designed to align incentives across vault managers, users, and the protocol itself — while reflecting the value accrued from activity across the ecosystem.

It acts as the primary mechanism through which Orion accrues fees, rewards performance, and facilitates long-term protocol sustainability.

Vault Fees

Vaults in Orion are permissionless, and can be created by anyone. Regardless of this, they generate fees through:

Performance and Management Fees

Vault managers have complete flexibility in determining their fee models, which can include:

- Performance fees that take a percentage of generated returns;

- Management fees charged as percentage of Total Value Locked (TVL).

To ensure aligned incentives, protocol participation and profitabilty, ORION accrues value proportionally to the fees set by vault managers.

Example

Alice creates a vault with a 10% performance fee and a 0.5% management fee, has a TVL of $1M and has a Cumulative Gross Return of 15%. Alice's vault will generate $20k in fees.

Bob creates a vault with a 20% performance fee and a 0.0% management fee, has a TVL of $500k and has a Cumulative Gross Return of 25%. Bob's vault will generate $25k in fees.

Mr. Orion creates a vault with a 5% performance fee and a 1% management fee, has a TVL of $750k and has a Cumulative Gross Return of 12%. Mr. Orion's vault will generate $12k in fees.

ORION will fully benefit from the $12k in fees generated by Mr. Orion's vault and proportionally from the $45k in fees generated by third-party vaults, based on the applicable fee-sharing structure.

This system encourages market-driven fee competition — where managers can experiment with strategies and pricing models while the protocol benefits from all vaults activity.

Bundling, Batching and Netting

Orion introduces bundling, batching and netting layers to reduce gas costs by combining and offsetting transactions between users, when possible. This feature plays a key role in the protocol’s fee dynamics:

- When transactions are processed within Orion, users pay only a fraction of the typical gas fees.

- A part of the saved cost is redirected to the Orion protocol treasury, accruing value in the token.

This creates a strong incentive to use Orion-native infrastructure for capital efficiency and cost savings — while benefiting the protocol.

Summary - Value Accrual in the ORION Token

| Source | Mechanism | Value to ORION Token |

|---|---|---|

| Third-Party Vault Fees | Fraction of third-party fee models | Indirect protocol revenue |

| Native Vault Fees | Performance/management fees | Direct allocation |

| Bundling Layer | Shared gas savings from transaction bundling | Protocol receives portion |

| Batching Layer | Shared gas savings from execution batching | Protocol receives portion |

| Netting Layer | Shared gas savings from peer-to-peer bartering | Protocol receives portion |