Financial Machine Learning

Orion is built on the principle that financial machine learning can make portfolio management radically more accessible.

We see financial machine learning as a tool to:

- Simplify decision-making for everyday users;

- Enhance performance for advanced managers;

- Automate allocation in dynamic market conditions.

To support a diverse range of user needs and intents, Orion enables two core approaches:

- Passive portfolio construction, powered by DeFi-native indexing and onchain metrics;

- Active, ML-driven management, where adaptive models optimize allocation and rebalancing.

This dual system lets vaults range from hands-off, rules-based strategies to fully adaptive, performance-seeking allocations — all within a unified, permissionless framework.

Passive Management: DeFi-Native Indexing

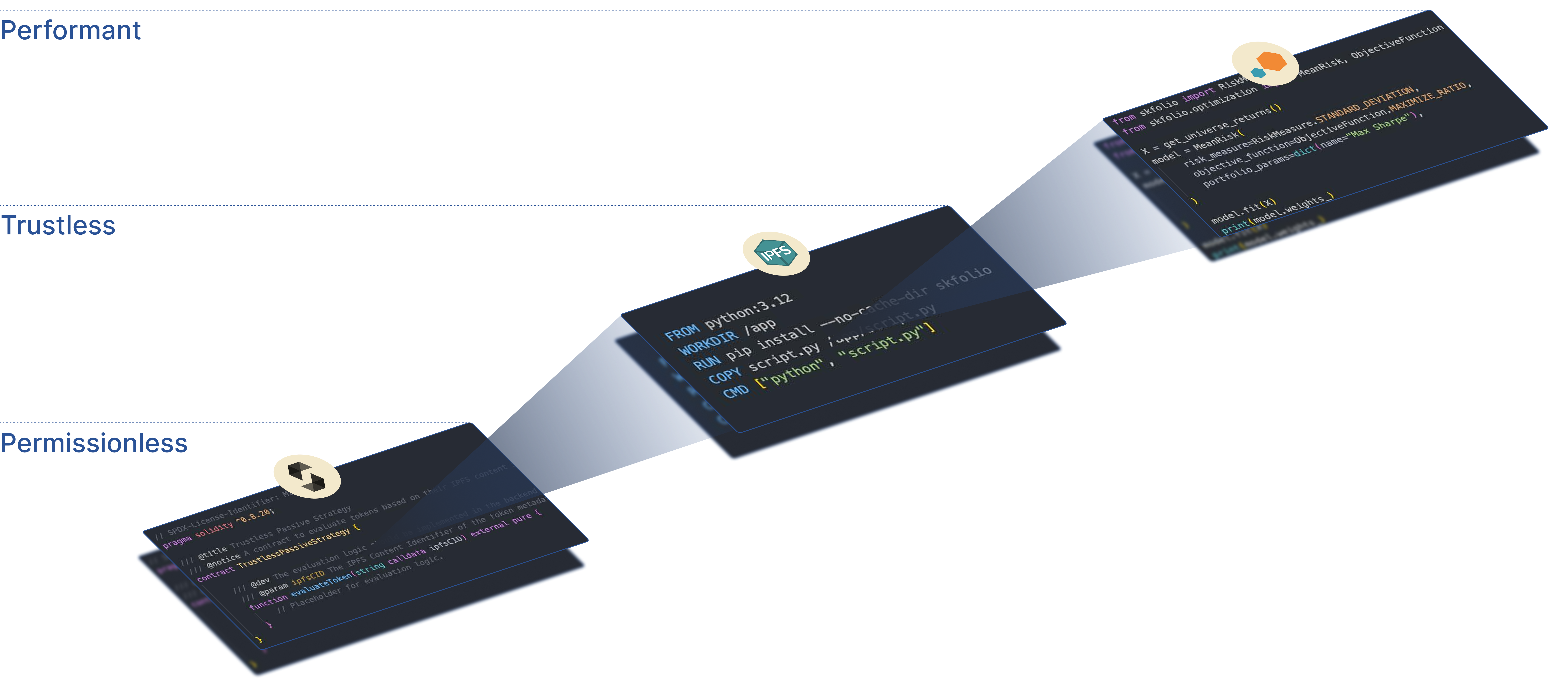

Orion enables a permissionless marketplace for onchain indexes — passive portfolios based on predefined rulesets, rebalanced automatically, and tokenized as ERC-20s.

We are building a system where:

- Users define index weights based on asset classes, themes, or rulesets;

- Orion integrates APIs from skfolio to define quantitative finance metrics (e.g., covariance, tail risk, train-test split) that inform onchain vault behavior.

- Index logic is encoded onchain via IPFS CIDs pointing to dockerized portfolio management logic, ensuring deterministic and verifiable index construction.

Example of a ruleset

from skfolio import RiskMeasure

from skfolio.optimization import MeanRisk, ObjectiveFunction

X = get_universe_returns()

model = MeanRisk(

risk_measure=RiskMeasure.STANDARD_DEVIATION,

objective_function=ObjectiveFunction.MAXIMIZE_RATIO,

portfolio_params=dict(name="Max Sharpe"),

)

model.fit(X)

model.weights_

This enables a whole new layer of user-defined and trustless indexes, based on advanced and computationally intensive financial machine learning rulesets.

Trust Guarantees

Every step of this process is verifiable and reproducible:

- Provenance: Methodology + data pinned on IPFS and CID pinned onchain;

- Reproducibility: Anyone can rerun the pipeline and validate the output;

- Audit Trail: All updates and rebalances are logged transparently onchain.

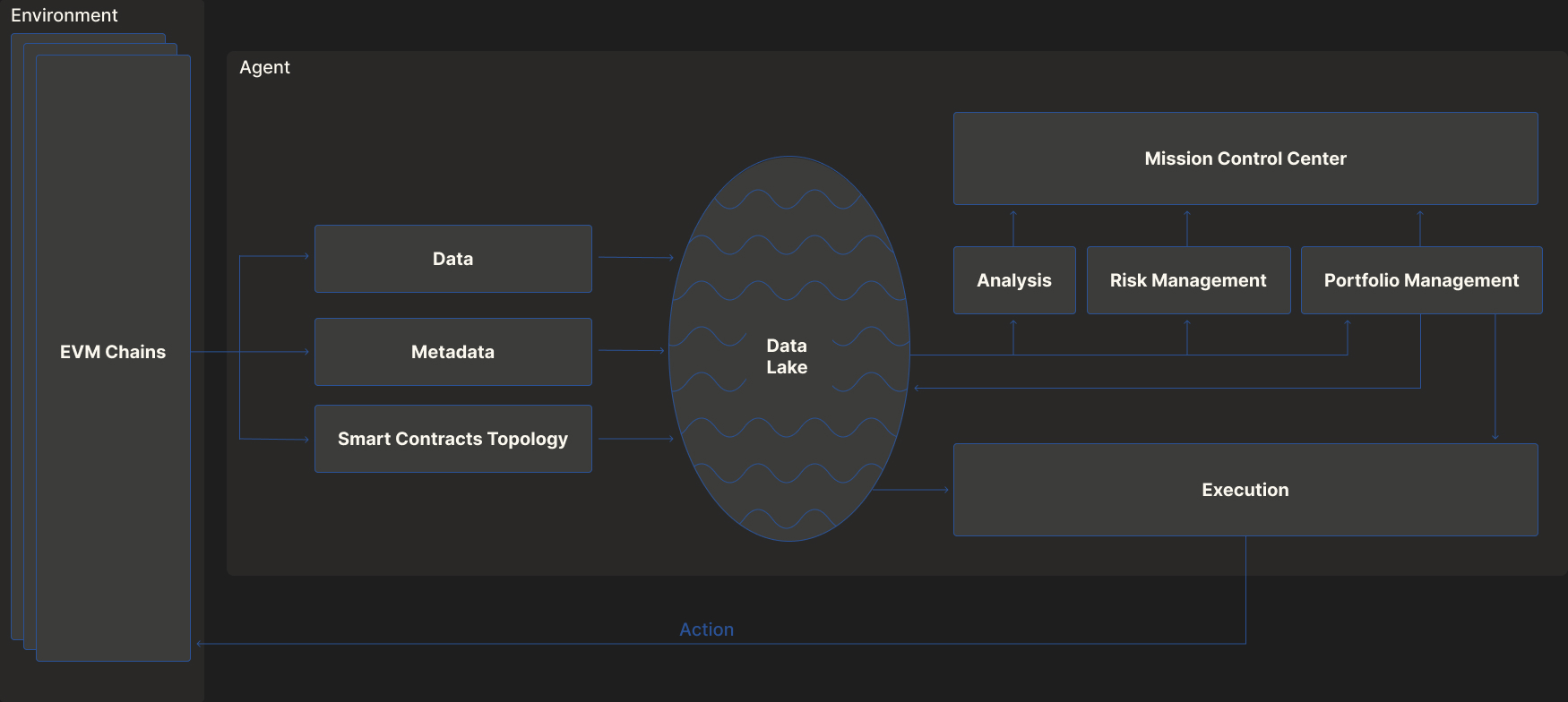

Active Management: ML-Optimized Vaults

For users seeking more sophisticated exposure, Orion supports financial machine learning (FML) pipelines that inform allocation, rebalancing, and dynamic optimization.

Our approach draws inspiration from academic and institutional-grade tools such as:

- Hierarchical risk parity;

- Adaptive expected return models;

- Online learning for portfolio allocation.

These models are either:

- Hardcoded into the vault strategy, based on parameterized ML outputs, or

- Queried dynamically via oracles or offchain computation layers (e.g., zkML, verifiable compute).

Orion abstracts this complexity for users, providing data, sdks and toolings, while allowing vault managers to go deeper — tuning model parameters, overriding logic, or composing hybrid strategies.